- March 25, 2021

Senators Marshall, Hickenlooper, Ernst Fight to get PPP Money to All Farmers and Ranchers

(Washington, D.C., March 25, 2021) – U.S. Senators Roger Marshall, M.D. (R-KS), John Hickenlooper (D-CO), and Joni Ernst (R-IA) today introduced legislation to ensure farmers and ranchers categorized as a partnership – many of which are small family partnerships – are able to use gross income when applying for Paycheck Protection Program (PPP) funds. Without this legislation, farmers and ranchers are forced to use net income, which is often low or negative because of the amount of depreciation that farmers claim on equipment.

“It’s no secret our nation’s farmers and ranchers have faced incredible difficulties through the COVID-19 pandemic. Unfortunately, certain farm and ranch partnerships, many of which are small family run business, were left out of changes made to the SBA’s Paycheck Protection Program in December. Our legislation would let farmers categorized as a partnership use gross income rather than net income when applying for this COVID relief,” said Senator Marshall. “When it comes to PPP, we must ensure no farmers or ranchers are left behind.”

“Family farmers and ranchers have had limited ability to access the Paycheck Protection Program because of a legislative technicality. This bill fixes this oversight so that our farming and ranching communities get the help they need to get through the pandemic,” said Senator Hickenlooper.

“Despite enormous challenges, Iowa’s farmers have continued to feed and fuel the world during COVID-19. And while some have been able to benefit from the Paycheck Protection Program, many of them—including partnerships and those who already had loans forgiven—have been unable to benefit from improvements made in the December COVID relief bill that give farmers access to more generous loans. In a recent Small Business Committee hearing, I called for changes to be made so these folks can benefit from a higher loan amount, and this bill makes that fix to ensure Iowa’s farmers are getting the support they deserve,” said Senator Ernst.

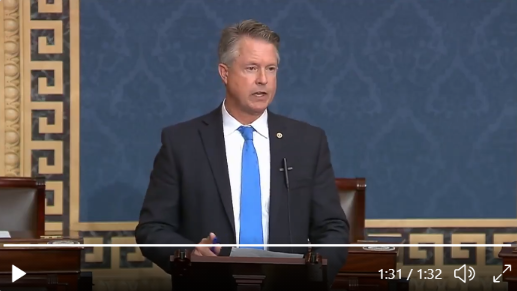

Additionally, Senator Marshall doubled down and offered an amendment to the PPP Extension Act and spoke on the Senate floor about it. You may click HERE or on the image below to watch Senator Marshall’s remarks.

Background:

The Marshall-Hickenlooper-Ernst bill would allow farmers and ranchers categorized as a partnership (including LLPs, S-Corps, etc.) to utilize gross income when calculating their PPP maximum loan amount. In December, Congress made changes to allow farmers to use gross income in calculating their PPP Loan. Before it passed, the payments were based on farmers’ net income, which is income after deductions and expenses. This number is often low or negative because of the amount of depreciation farmer’s claim on equipment.

These changes were helpful and have provided assistance for much of the agriculture industry. Unfortunately, certain farm and ranch partnerships were left out of changes made to the program in December. While Congress intended to include partnerships, the SBA, interpreting the statute that was passed, did not. SBA has made it clear, short of legislation, that they would not include partnerships under the new interpretation.

Representative Jim Hagedorn introduced the companion legislation in the House of Representatives.

###