- September 7, 2022

Sen. Marshall: Credit Card Swipe Fees are an Inflation Multiplier

(Washington, D.C., September 7, 2022) – U.S. Senator Roger Marshall, M.D. joined Making Money with Charles Payne on Fox Business this afternoon to discuss the Credit Card Competition Act. Senators Marshall and Dick Durbin (D-IL) introduced this bipartisan legislation to slash credit card swipe fees and enhance competition and choice in the credit card market. While you may click HERE or on the image below to watch Senator Marshall’s interview, he said in part,

“I am always going to fight for Main Street when it is Main Street versus Wall Street. I am going to fight for consumers. Right now, consumers are feeling the pinch of inflation – these credit card swipe fees increase that inflation… Swipe Fees are an inflation multiplier. I think this will be good for the market. Capitalism needs competition. Right now, two credit card companies control 83% of the market. Despite their profits going up by 25%, they still increased their rate this year. So what we do is introduce competition, not price caps. We want more competition…”

Background:

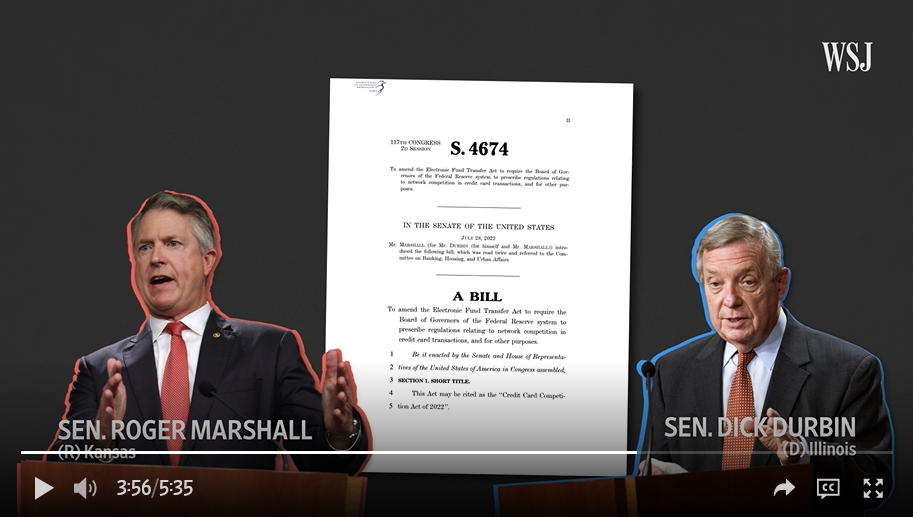

The Wall Street Journal highlighted Senator Marshall’s legislation in a video report called Why Using Your Credit Card Is Getting More Expensive, which explains that the costs for processing credit card transactions have increased and how businesses are passing those higher costs onto consumers or declining to accept credit card payments. You may click HERE or on the image below to watch the full report.

Recently, Senator Marshall visited a QuikTrip in downtown Wichita to work behind the counter and see the issue of rising swipe fees first hand. The QuikTrip Senator Marshall visited is one of 1,213 convenience stores across Kansas, which pay more than $110 million in credit card fees annually – their second highest operating cost behind labor. You may click on any of the three images below to watch KAKE, KWCH, and KSNW coverage of Senator Marshall’s QuikTrip swipe fee event.

Additionally, Senator Marshall recently penned two op-eds on the Credit Card Competition Act of 2022. You may click HERE to read his piece in the Kansas City Star/Wichita Eagle or HERE to read his piece in the Washington Examiner.

There are currently four U.S. credit card networks: Visa, Mastercard, American Express, and Discover. Visa and Mastercard are known as “four-party” networks; they act as agents for thousands of card-issuing banks and mandate the fees and terms that the banks receive from merchants for each transaction. Merchants have effectively no leverage to negotiate fee rates and terms in four-party network systems, because they cannot risk losing access to all the consumers served by Visa’s and Mastercard’s member banks.

Visa and Mastercard wield enormous market power in credit cards; according to the Federal Reserve, they account for nearly 576 million cards, or about 83 percent of general-purpose credit cards. Approximately $3.49 trillion was transacted on Visa and Mastercard credit cards in the U.S. in 2021. Visa’s and Mastercard’s market power and network structure have enabled them to impose fees on U.S. merchants that are among the world’s highest, charging a total of $77.48 billion in U.S. merchant credit card fees in 2021. These fees include interchange or swipe fees which Visa and Mastercard require merchants to pay to issuing banks, as well as network fees that Visa and Mastercard require merchants to pay directly to them. Consumers ultimately pay for all of these fees in the price of the goods and services they buy.

Under the Credit Card Competition Act, the Federal Reserve would issue regulations, within one year, ensuring that banks in four-party card systems that have assets of over $100 billion cannot restrict the number of networks on which an electronic credit transaction may be processed to less than two unaffiliated networks, at least one of which must be outside of the top two largest networks. This would inject real competition into the credit card market—opening the door for new market entrants such as current debit-only networks, encouraging innovation and enhanced security, creating backup options if a network crashes, and exerting competitive constraints on Visa and Mastercard’s fee rates.

In April, Durbin, Marshall, and U.S. Representatives Peter Welch (D-VT) and Beth Van Duyne (R-TX) sent a bipartisan, bicameral letter to the CEOs of Visa and Mastercard urging the companies not to proceed with plans to raise their interchange fee rates. Visa and Mastercard nonetheless proceeded to raise fee rates, prompting Durbin to hold a Senate Judiciary Committee hearing in May on excessive swipe fees and barriers to competition in the credit card system.

###